Broadband Internet service has never been regulated like old-fashioned telephone lines -- classified as “Title II” under the Telecommunications Act. The FCC settled the matter definitively in 1998, when Clinton-appointed FCC Chairman William Kennard demolished the same reclassification arguments being made today in that year’s Report to Congress:

Our findings in this regard are reinforced by the negative policy consequences of a conclusion that Internet access services should be classed as “telecommunications” … Classifying Internet access services as telecommunications services could have significant consequences for the global development of the Internet. We recognize the unique qualities of the Internet, and do not presume that legacy regulatory frameworks are appropriately applied to it.

If Chairman Genachowski announces, as expected, his intention to reclassify the Internet as a telephone system, he will be reversing 30 years of precedent starting with the Carter administration FCC’s “Computer II” decision and definitively settled with respect to broadband Internet access by the Clinton FCC in 1998. Turning sharply left from Carter and Clinton indicates a pretty extreme shift beyond the mainstream of American politics.

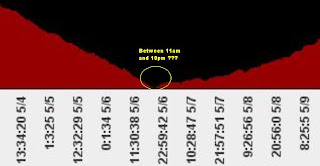

AND JUST AS I SUSPECTED-- GOOGLE HAS TAKEN A HIT ALREADY

GOOG - Google Inc. (NASDAQ)

| 498.67 -11.09 (-2.18%) 6 May 4:00pm ET 491.01 -7.66 (-1.54%) After Hours | ||||||||||||||

|

| |||||||||||||

.

ITS MORE THAN JUST GOOGLE ITS THE GREECE DEBT CRISIS TOO

HONG KONG — Fears of a contagion caused by Greece's debt crisis sent Asian stock markets into a tailspin Wednesday while the euro sank to a fresh one-year low.

Regional investors went into sell-off mode after European and US markets dived on fears that a 110-billion-euro rescue package for Athens may not be enough and rumours that Spain was also seeking a bailout.

The euro sank to 1.2969 US dollars by 0450 GMT, down from 1.2981 in New York late Tuesday and to 122.98 yen from 125.10.

Jitters intensified on reports of mounting public outrage in Greece, where a general strike was under way Wednesday and workers have taken to the streets protesting at wage and spending cuts.

"The market is literally not buying the notion that the 110 billion euro aid package for Greece is a panacea," said Patrick O'Hare of Briefing.com

"The message of the markets is that European officials have more to do to prove that they have the resolve to keep Greece's problems from spreading."

Sydney fell 1.33 percent, or 63.1 points, to end at 4,674.00, while Hong Kong dived 2.10 percent, or 435.51, to end at 20,327.54.

Tokyo and Seoul were closed for public holidays.

Asian exporters were also hit by the plummeting euro as it makes imports for European companies more expensive.

Analysts questioned whether the bailout would be enough to allow Greece to raise its own private financing on bond markets by next year.

"After a closer examination of the Greek financials, the 110 billion euros on the table from the EU and IMF will not be sufficient unless private markets start lending again," said Currencies Direct analyst Philip Ryan.

Greece turned to the eurozone and IMF for help after its borrowing costs surged when the scope of its debt and public deficit crisis became fully apparent.

On Tuesday, Greece's cost of borrowing through 10-year bonds rose to nearly 9.4 percent interest, up from just under 8.5 percent on Monday.

Concerns of contagion were stoked Tuesday following rumours that Spain would also soon have to go cap-in-hand to the International Monetary Fund for a 280-billion-euro bailout.

But Spanish Prime Minister Jose Luis Rodriguez Zapatero dismissed the stories as "absolute madness" while the IMF also said there was "no truth" to the rumours.

European markets were hammered, with Athens diving 6.68 percent, Madrid 4.70 percent lower, London 2.56 percent off, Frankfurt down 2.60 percent and Paris 3.64 percent lower.

The fear also hit Wall Street, where the Dow fell two percent, with exporters also suffering from a stronger dollar.

In Asia, the greenback was trading at 94.82 yen compared with 94.64 in late US trade Tuesday.

The stronger US unit weighed on the price of oil and gold. New York's main contract, light sweet crude for June, was down 17 cents at 82.57 dollars a barrel. Brent North Sea crude for June delivery dipped eight cents to 85.59 dollars a barrel.

Gold closed 1,165.00-1,166.00 US dollars an ounce in Hong Kong, down from Tuesday's close of 1,178.00-1,179.00 dollars.

Sydney stocks continued to be pressured by a proposed 40 percent tax on the "super profits" of mining companies -- those deemed to be to be above reasonable expected earnings -- announced by Prime Minister Kevin Rudd Sunday.

However, most heavyweights rebounded with miner BHP Billiton up 0.39 percent and rival Rio Tinto 1.82 percent higher, well off earlier losses due to bargain hunting.

Shanghai jumped 0.77 percent, or 21.87 points, to close at 2,857.15 as bargain hunters moved in after the index hit an eight-month low earlier in the day.

Despite the gains, dealers are still on edge due to the Greek crisis as well as China's latest moves to rein in lending as part of a bid to cap property prices.

Copyright © 2010 AFP. All rights reserved.

http://www.google.com/hostednews/afp/article/ALeqM5iB-vlERHo1XpQ9cjf2rFr7Ge81eA

No comments:

Post a Comment